Guided Wealth Management Things To Know Before You Buy

Guided Wealth Management Things To Know Before You Buy

Blog Article

How Guided Wealth Management can Save You Time, Stress, and Money.

Table of ContentsGetting My Guided Wealth Management To WorkOur Guided Wealth Management PDFsThe Best Strategy To Use For Guided Wealth ManagementSome Known Details About Guided Wealth Management Not known Details About Guided Wealth Management

Below are 4 points to consider and ask yourself when determining whether you should tap the knowledge of a monetary advisor. Your web well worth is not your earnings, however instead a quantity that can assist you comprehend what cash you make, just how much you conserve, and where you spend cash, as well.Properties include investments and checking account, while obligations include charge card bills and home loan payments. Naturally, a favorable total assets is much much better than an adverse total assets. Looking for some direction as you're reviewing your economic circumstance? The Consumer Financial Security Bureau supplies an online quiz that helps determine your economic health.

It's worth keeping in mind that you do not need to be rich to seek recommendations from an economic advisor. A major life adjustment or choice will cause the choice to browse for and work with a monetary consultant.

These and other significant life occasions might prompt the requirement to check out with a monetary advisor about your financial investments, your financial objectives, and other financial issues (superannuation advice brisbane). Let's state your mom left you a neat amount of cash in her will.

The Definitive Guide to Guided Wealth Management

In basic, a financial expert holds a bachelor's level in an area like financing, bookkeeping or organization administration. It's likewise worth nothing that you could see an expert on an one-time basis, or job with them a lot more frequently.

Any person can state they're an economic advisor, but an advisor with expert designations is preferably the one you must work with. In 2021, an estimated 330,300 Americans worked as personal economic advisors, according to the united state Bureau of Labor Statistics (BLS). A lot of economic consultants are independent, the bureau claims. Normally, there are five sorts of financial consultants.

Unlike a signed up agent, is a fiduciary who should act in a customer's ideal rate of interest. Depending on the value of assets being taken care of by a signed up investment expert, either the SEC or a state securities regulatory authority oversees them.

Guided Wealth Management - Truths

As a whole, though, financial planning specialists aren't managed by a solitary regulator. An accountant can be thought about a monetary coordinator; they're regulated by the state audit board where they exercise.

Offerings can include retirement, estate and tax obligation planning, in addition to investment administration. Wide range managers generally are signed up agents, meaning they're managed by the SEC, FINRA and state securities regulators. A robo-advisor (financial advice brisbane) is an automated online investment supervisor that counts on algorithms to deal with a customer's assets. Customers typically do not get any kind of human-supplied economic guidance from a robo-advisor solution.

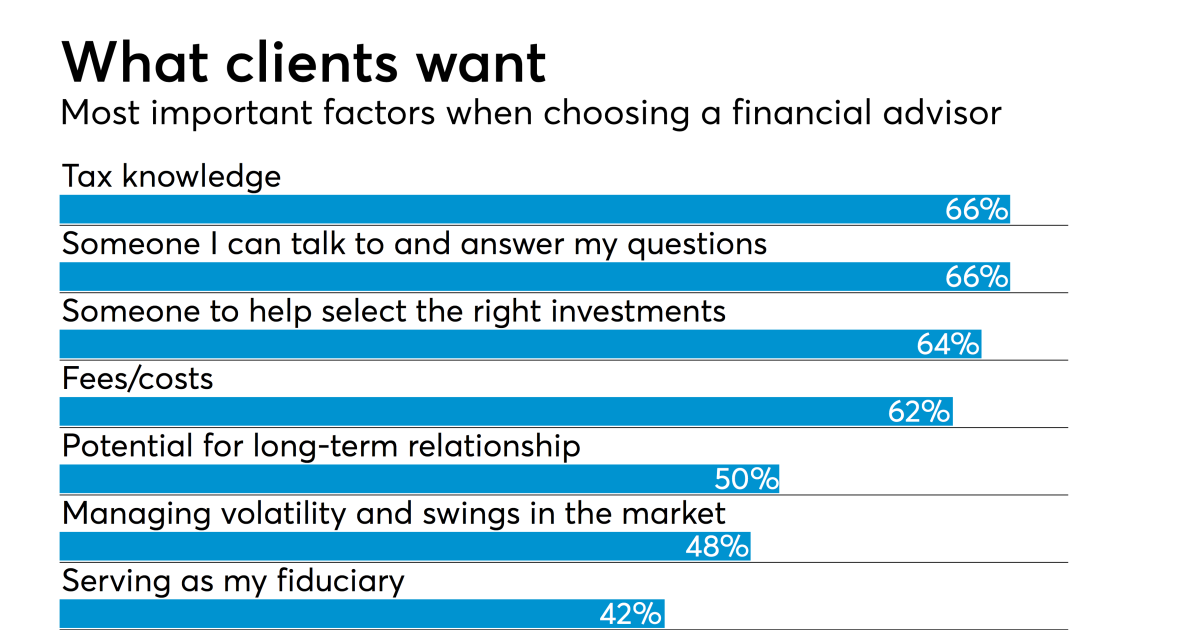

They generate income by billing a fee for every trade, a flat month-to-month cost or a percent cost based upon the buck quantity of possessions being managed. Capitalists trying to find the best advisor should ask a variety of concerns, consisting of: A monetary advisor that collaborates with you will likely not be the exact same as an economic advisor who deals with another.

How Guided Wealth Management can Save You Time, Stress, and Money.

Some advisors may benefit from selling unnecessary products, while a fiduciary is lawfully needed to pick investments with the customer's needs in mind. Choosing whether you need a financial expert includes evaluating your financial circumstance, figuring out which kind of financial expert you need and diving into the history of any economic consultant you're thinking Learn More of working with.

To achieve your objectives, you might require a proficient expert with the appropriate licenses to aid make these plans a truth; this is where an economic advisor comes in. Together, you and your consultant will cover many topics, consisting of the quantity of cash you should save, the types of accounts you need, the kinds of insurance you ought to have (consisting of long-lasting care, term life, special needs, etc), and estate and tax preparation.

The Basic Principles Of Guided Wealth Management

At this factor, you'll likewise let your consultant understand your financial investment preferences also. The first assessment might likewise include an evaluation of other financial monitoring topics, such as insurance concerns and your tax obligation scenario. The consultant requires to be familiar with your present estate plan, along with other professionals on your preparation team, such as accounting professionals and legal representatives.

Report this page